Seven suggestions to help you get home financing

Within this publication

Higher home loan rates combined with exorbitant domestic pricing have actually made it more complicated to own first-time buyers especially to acquire a toes to the the brand new casing hierarchy. Here we display suggestions.

Home loan rates are soaring in britain once consecutive nature hikes in order to the financial institution out of England bank rate, that have banking companies so much more cautious so you’re able to lend in this environment. But there’s something you can certainly do to boost your odds of taking home financing.

step 1. Build a more impressive deposit

You are able to get a mortgage in just a good short put regarding just 5%, but this minimises your chances of to be able to manage a good mortgage.

For the reason that how big is the borrowed funds you would you prefer to carry out will be a lot larger, so your earnings might not increase much enough to own a lender to trust you really can afford it.

- For those who have a little ?10,000 deposit into the good ?2 hundred,000 domestic, you’d you want a good ?190,000 home loan

- However with a beneficial ?20,000 deposit on the same domestic, might you need an inferior mortgage from ?180,000

If you can abrasion to each other a much bigger put, the likelihood is there can be down interest levels and you can a wider choice.

When you find yourself weigh up whether to pull out a tiny deposit mortgage, we story the huge benefits and downsides. We plus make it easier to see the different kinds of mortgage loans.

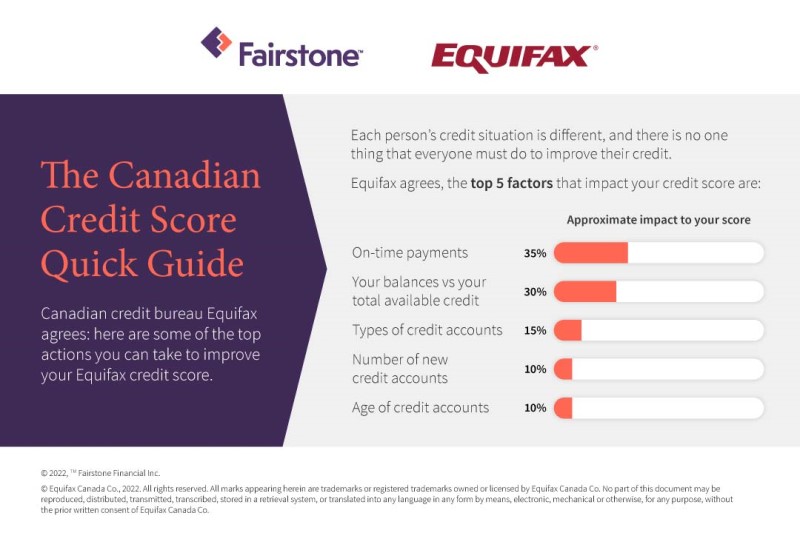

dos. Change your credit history

Your credit history suggests your own percentage history for the past half a dozen many years, together with playing cards, unsecured loans and fund arrangements. Non-payment off utility bills and you can portable deals may also be entered.

Check your borrowing info with the around three main credit reference agencies really before and make their financial app.

- Test your credit file for free through ClearScore (to possess Equifax)

- MoneySavingExpert’s Credit Club (having Experian)

- Credit Karma*(to own TransUnion)

You need to know restoring people factors prior to it scupper your chances of going a decent rate of interest of a lender otherwise being qualified getting a mortgage after all.

You will find several short gains to have improving your credit score, such as registering to choose. We go into these types of in detail within book toward credit scores.

step three. Decrease your outgoings

Whenever obtaining a home loan, lenders would like to look at the earnings and you may outgoings while making certain that you could potentially conveniently pay the repayments.

Thus on days prior to your mortgage software you should seek to keep the outgoings as low as you’ll be able to. You might want to prevent splashing the money towards the some thing beyond basic principles.

Lenders will even scrutinise the lender statements for cues you you are going to struggle with existing loans. Avoid using overdrafts and you can lower balances into the playing cards, store cards and you may signature loans.

Definitely prevent making an application for any the fresh finance otherwise playing cards and that perform trigger a beneficial hard review your credit report. If you have had several present tough inspections on your own document, a home loan company often see it an indication which you are in monetary difficulties.

cuatro. Pin down documentation

Locate all documentation necessary for a home loan software now, which means you usually do not miss out on that loan on account of a lost payslip.

- Proof of identity including a creating licence and you will passport

- Financial statements for the last at least three months

- Proof income such as payslips during the last three months (or extended while worry about-employed)

- Deals statements to prove your own put

- Recent electric bills to show evidence of address

5. Use a mortgage broker

Which have fewer mortgage loans available and you may modifying lending regulations, a mortgage broker normally scour the market industry for the best price. An effective mortgage agent will suggest and therefore loan providers much more most likely so you can agree the job.

Respuestas