For individuals who cash-out an investment who has grown over time, you’ll be able to owe taxes towards boost in worth (i

Brown told you cities across the state is actually unveiling pilot software all committed to advertise ADUs, that it is practical to store tabs on exacltly what the local bodies is doing. Content try appearing every where; you just have to secure the scanner supposed, she told you.

Personal possessions

Dipping into the offers and you may opportunities to cover at the least part of your own cost of an enthusiastic ADU make sense, but it’s not a simple decision. In reality, only considering the details involved makes your mind damage.

What you are trying to would is actually compare exacltly what the discounts you will definitely earn if the left where he’s against what you can cut when you look at the appeal repayments and you can what you are able gain out-of higher assets thinking. But until your finances is actually invested in anything having a predetermined come back, such a certificate out of put, otherwise parked someplace one will pay no desire, instance a checking account otherwise a mattress, that you don’t know what your next earnings is. Instead, you have to check how equivalent expenditures features did from inside the for the past. Particularly, high company stocks have cultivated almost six.3% a-year from inside the worthy of once the 2000, maybe not modifying for rising cost of living.

Also, you do not understand how much your house worth increases once their ADU is created. Property philosophy has actually increased when you look at the L.A beneficial. County over the past several years, increasing by the regarding 8% annually an average of. However it is come a bumpy drive some times; median family sale cost was on the 12% low in than simply they had held it’s place in Can get.

Are you presently building a keen ADU or considering that? Are you experiencing facts to fairly share or unanswered inquiries? Otherwise horror tales? Let us know.

The other effect try fees. e., the capital obtain) as high as 20% towards one another your state and federal returns. That produces the very thought of having fun with offers to minimize your own financing reduced tempting.

Exacltly what the financial investments was earning, simply how much they’ve got gathered and you will exactly what income tax class you reside tend to every apply at the calculations. Nonetheless, the higher the interest rates towards the financing climb, the easier its to really make the financial situation to possess moving on the their savings and you may investment out of brings and you may securities to a keen ADU.

For those who have an effective 401(k), your employer will get allow you to use from it to construct your own ADU. Around Irs legislation, new loans have to be paid down in this five years. Also, they are capped on $50,000 or 50 % of your own vested number, any type of is lower.

The newest distinctive line of benefit of tapping their 401(k) is the fact that attract you only pay into loan will go back once again to your account, never to a bank or other lender. However, except if the interest rate is at least of up to the fresh new output in your 401(k) opportunities, you will be cutting your old age offers along side long haul. And when you never spend the money for financing right back punctually, the rest harmony might possibly be taxed given that normal income and you will, when you’re less than 59? yrs old, susceptible to an extra ten% punishment to own very early withdrawal.

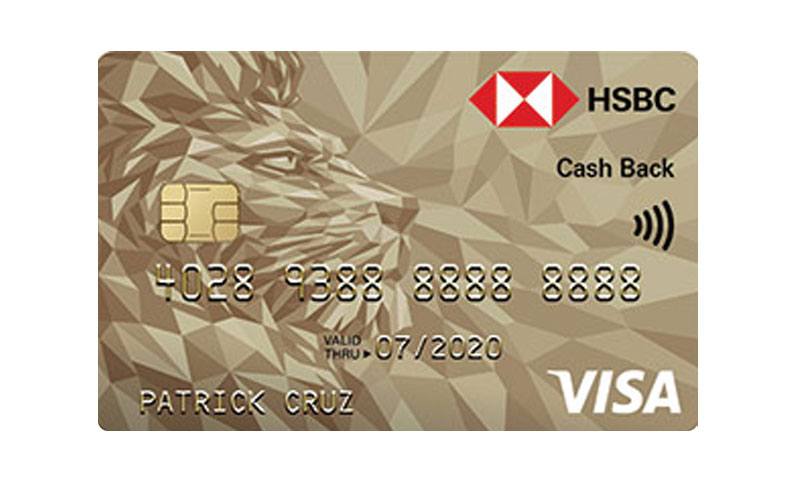

Brown told you you could potentially cobble to one another a bunch of quick-title assist – instance, borrowing of family, taking out a 401(k) loan and maxing out your credit cards – upcoming spend everything straight back because of the refinancing your mortgage with additional financial obligation to cover their ADU will cost you. And when you are doing they like that, she told you, Freddie Mac’s recommendations enable lenders to help you reason behind the fresh new rental income from your own freshly founded ADU.

So it, too, is ways to borrow secured on the equity of your house, you would not you will need to repay the borrowed funds otherwise create monthly obligations

In the long run, while 62 or earlier, an extra choice is an other home loan. As an alternative, the debt will grow since the notice accrues until the home is marketed.

Respuestas